"Support The Mishty Foundation"

Make a Difference Today!

Your money can bring hope, health, and happiness to someone in need.

At The Mishty Foundation, your donation goes directly into programs that uplift underprivileged children, women, and families. Whether it's providing education, health services, or emergency relief — every contribution matters.

✅ 100% Transparent Process ✅ Government-Registered & Verified Trust ✅ Tax-Exempt Donations (if applicable) ✅ Every Rupee Creates Real Impact

"Bank Details for Money Donation"

✅ Name: THE MISHTY FOUNDATION

✅ Account number: 2502254964659784

✅ IFSC: AUBL0002549

✅ Bank name: AU Small Finance Bank

✅ Branch: Delhi Preet Vihar

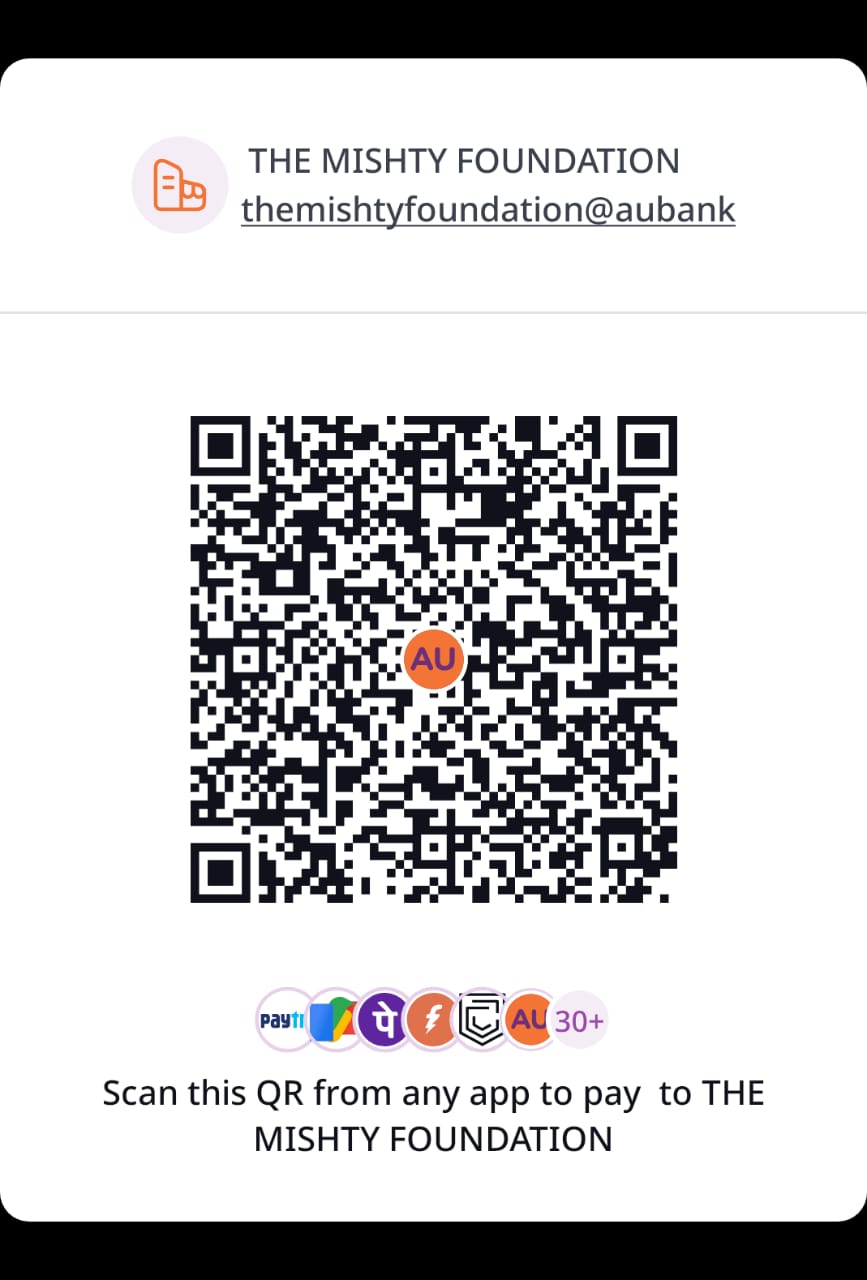

"Prefer UPI or QR Code?"

✅ UPI ID : merchant1528852.augp@aubank (Bank UPI)

✅ UPI ID : themishtyfoundation@aubank (Bank UPI)

✅ Rezorpay Id: razorpay.me/@themishtyfoundation

"Tax Benefit Under 80G"

Your donation is 100% secure and eligible for tax deduction under Section 80G of the Income Tax Act.

"Section 80G Tax Exemption for DonationsTo TMF"

✅ What is Section 80G?

Section 80G of the Income Tax Act, 1961 allows an individual, company, or any taxpayer to claim a deduction for donations made to certain charitable institutions and relief funds, including registered NGOs and Trusts.

- "Eligibility Criteria for Donor"

To claim tax relief under 80G:

The donor must have taxable income in India.Donation must be made to an 80G-registered NGO/trust.

Donation must be made via cheque, draft, UPI, bank transfer, or any other non-cash mode.

Cash donations are eligible only up to ₹2,000.

Receipt of donation must include:

Name and PAN of the trust

Name and PAN of the donor

Amount donated

Date of donation

Registration number of 80G with validity

"How Donors Can Claim Tax Relief"

Step-by-Step Guide:

Make a donation to The Mishty Foundation using:Bank Transfer (NEFT/IMPS/RTGS)

UPI (PhonePe/Google Pay etc.)

Debit/Credit Card

Cheque/Demand Draft

Collect the following from Mishty Foundation:

Donation Receipt

80G Certificate Details

Form 10BE (issued annually by 31st May)

Declare your donation in the Income Tax Return (ITR) under Section 80G

Attach the PAN and 80G details of the foundation in your filing portal

"Donation Categories under 80G"

| Category | Deduction Allowed |

|---|---|

| Donations with 100% deduction | Without upper limit |

| Donations with 50% deduction | Without upper limit |

| Donations with 100% deduction | With qualifying limit (10% of gross income) |

| Donations with 50% deduction | With qualifying limit (10% of gross income) |

"Need Help or Receipt?"

Feel free to WhatsApp us or email our support team with your transaction details for an official receipt and updates.

✅ WhatsApp: 9953531403

✅ Email: themishtyfoundation@gmail.com

✅ Website: www.mishtyfoundation.com

? Please mention your name and mobile number in the remarks while donating.

Donations to The Mishty Foundation are eligible for 100% tax deduction under Section 80G of the Income Tax Act, 1961

"Every Contribution Counts"

Together, we can build brighter futures and bring hope where it's needed most.

Thank you for your trust and support

With gratitude,

Team Mishty Foundation